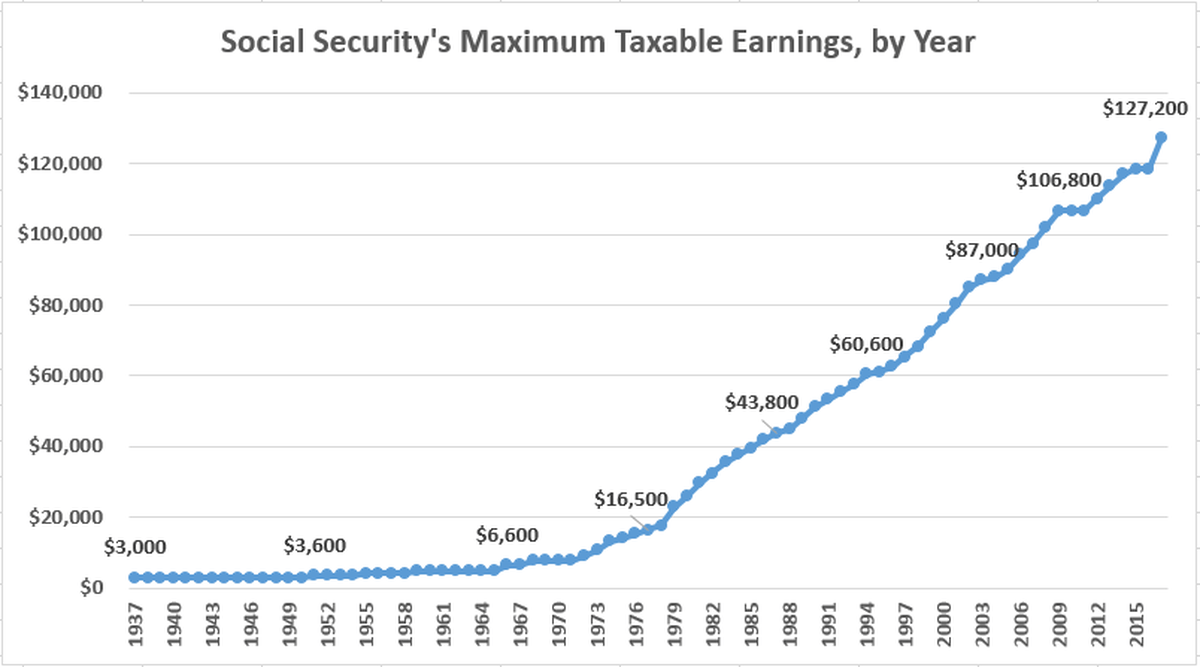

Max Amount Social Security Tax 2025. You file a federal tax return as an individual and your combined income is more than $34,000. Earnings above that threshold aren't taxed for social security.

You file a federal tax return as an individual and your combined income is more than $34,000. As a result, the maximum social security tax jumps from $9,932 to $10,453.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Up to 85% of your social security benefits are taxable if: The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

Limit For Maximum Social Security Tax 2025 Financial Samurai, For example, the maximum amount of earnings subject to social security payroll tax in 2025 will be higher. The maximum social security employer contribution will.

The Rich Will Owe This Much Social Security Tax in 2019 The Motley Fool, For earnings in 2025, this base. The maximum social security employer contribution will.

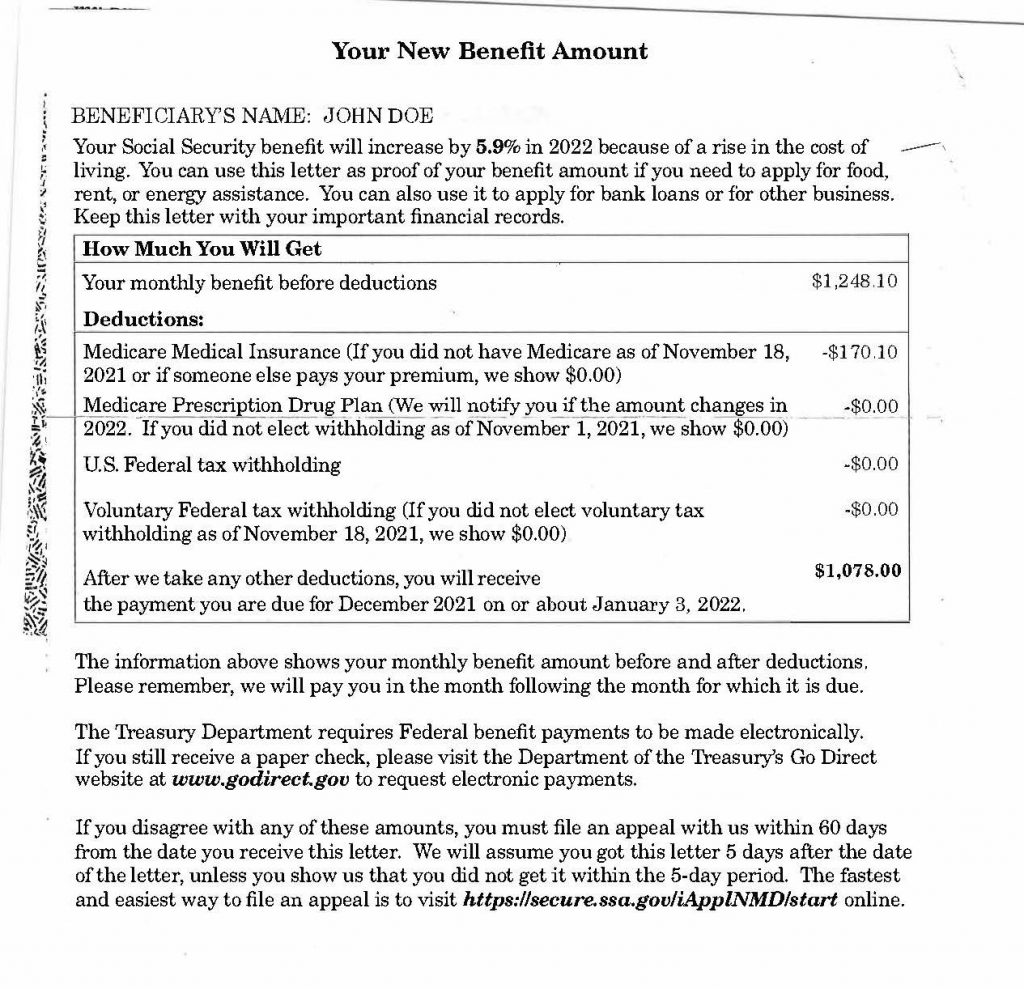

Paying Social Security Taxes on Earnings After Full Retirement Age, But beyond that point, you'll have $1 in benefits withheld per $2 of. The amount you receive in social security benefits each month will have an impact on your overall retirement budget.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Calculate Taxable Portion Of Social Security, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62. Only the social security tax has a wage base limit.

Maximum Taxable Amount For Social Security Tax (FICA), In 2025, you can earn up to $22,320 without having your social security benefits withheld. Here's what that means for benefit maximums.

Save Your Social Security COLA Notice, For example, the maximum amount of earnings subject to social security payroll tax in 2025 will be higher. This amount is also commonly referred to as the taxable maximum.

Social security taken out of paycheck JubranShuman, If you are working, there is a limit on the amount of your earnings that is taxed by social security. You file a federal tax return as an individual and your combined income is more than $34,000.

Maximum Taxable Amount For Social Security Tax (FICA), Social security benefits increased by 3.2% in 2025. The 2025 tax limit is $8,400 more than the 2025 taxable.

How To Calculate, Find Social Security Tax Withholding Social, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. Only the social security tax has a wage base limit.