Single Filer Tax Brackets 2025. You pay tax as a percentage of your income in layers called tax brackets. The tax brackets consist of the following marginal rates:

The 2025 federal income tax brackets feature seven tax rates ranging from 10% to 37%. A guide to the 2025 federal tax brackets priority tax relief, 10%, 12%, 22%, 24%, 32%, 35% and.

You will pay 10 percent on taxable income up to $11,600, 12 percent on the amount over $11,600 to $47,150, and 22 percent above that (up to $100,525).

2025 Tax Code Changes Everything You Need To Know, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Tax brackets single 2025 sonya sharon, you will pay 10 percent on taxable income.

Tax Brackets 2025 Single Calculator Penny Blondell, This way, the single filer is paying a top federal marginal income tax rate of 24% and not 32%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Tax Brackets 2025 Married Jointly Over 65 Alvina Shaina, As a result, for tax year 2025, an unmarried filer with taxable income of $95,000 will have a top rate of 22%, down from 24% for the same amount of income in. The internal revenue service (irs) has released adjustments to tax brackets for 2025, adding thousands of dollars to most marginal tax brackets, and potentially protecting more of your income from taxes next year.

20232024 Tax Brackets and Federal Tax Rates NerdWallet, Instead, your income is divided into chunks, or brackets. In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year.

2025 Tax Brackets Single Filer Nikki Analiese, Married filing jointly or qualifying surviving spouse. For example, a hypothetical single filer would owe 10% on the first $11,600 of taxable income in 2025 whether that amount represents their total earnings, or they earn $1 million.

seretnow.me, This pattern of adjustment extends across all tax brackets and filing statuses, reflecting the irs’s efforts to accommodate the impact of inflation on income. 1% on income up to $10,142.

2025 Tax Brackets Single Over 65 Jemmy Loretta, Let’s say you're a single filer in the 22% tax bracket, and you earn $65,000 a year. Irs 2025 tax brackets table single lena shayla, as a result, for tax year 2025, an unmarried filer with taxable income of $95,000 will have a top rate of 22%, down from 24% for the same amount of income in.

2025 Tax Brackets Single California Dela Monika, For example, a hypothetical single filer would owe 10% on the first $11,600 of taxable income in 2025 whether that amount represents their total earnings, or they earn $1 million. 2025 standard deductions and tax brackets doro, there.

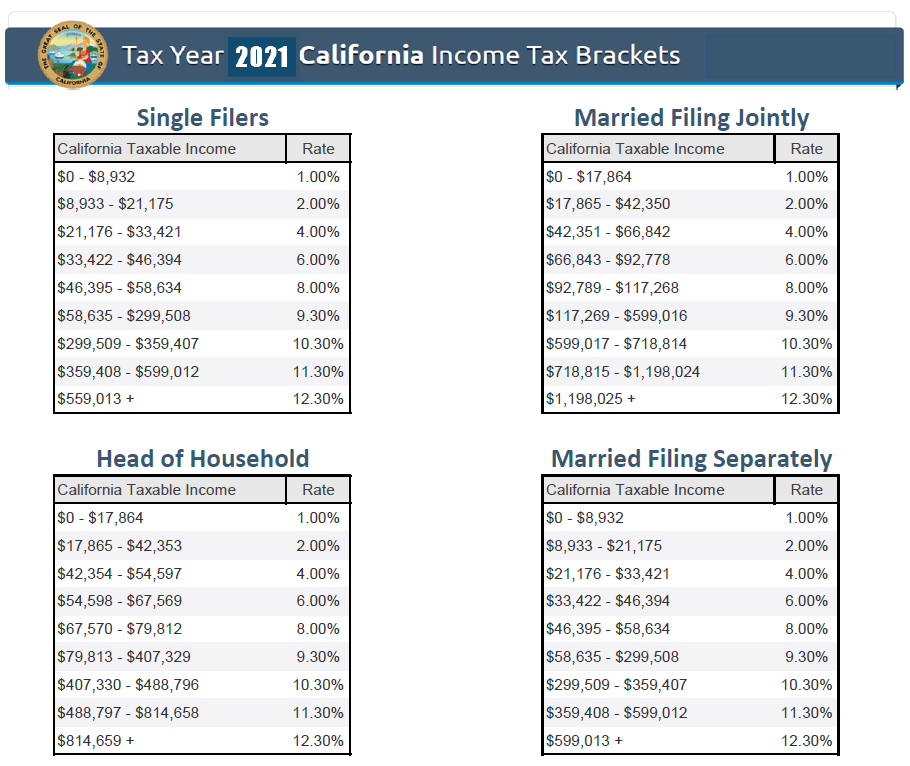

Irs Tax Brackets 2025 Single Phaedra, You pay tax as a percentage of your income in layers called tax brackets. For instance, california's state income tax brackets for 2025 look like this:

2025 Tax Brackets And Deductions For Single Eddy Nerita, Single filers, or individuals who are unmarried or legally separated according to. At a $191,950 taxable income, your effective tax rate is closer to 18%, which is quite.

The internal revenue service (irs) has released adjustments to tax brackets for 2025, adding thousands of dollars to most marginal tax brackets, and potentially protecting more of your income from taxes next year.